# load packages

library(tidyverse)

library(broom)

library(mosaic)

library(ISLR2)

library(patchwork)

library(knitr)

library(coursekata)

library(kableExtra)

library(scales)

# set default theme and larger font size for ggplot2

ggplot2::theme_set(ggplot2::theme_minimal(base_size = 16))

# Create new variable

Credit <- Credit |>

mutate(Has_Balance = factor(ifelse(Balance == 0, "No", "Yes")))Multiple linear regression (MLR)

Application Exercise

📋 AE 13 - Multiple Linear Regression and Categorical Predictors

Complete Exercise 0-3.

Computational setup

Considering multiple variables

Data: Credit Cards

The data is from the Credit data set in the ISLR2 R package. It is a simulated data set of 400 credit card customers.

Rows: 400

Columns: 12

$ Income <dbl> 14.891, 106.025, 104.593, 148.924, 55.882, 80.180, 20.996,…

$ Limit <dbl> 3606, 6645, 7075, 9504, 4897, 8047, 3388, 7114, 3300, 6819…

$ Rating <dbl> 283, 483, 514, 681, 357, 569, 259, 512, 266, 491, 589, 138…

$ Cards <dbl> 2, 3, 4, 3, 2, 4, 2, 2, 5, 3, 4, 3, 1, 1, 2, 3, 3, 3, 1, 2…

$ Age <dbl> 34, 82, 71, 36, 68, 77, 37, 87, 66, 41, 30, 64, 57, 49, 75…

$ Education <dbl> 11, 15, 11, 11, 16, 10, 12, 9, 13, 19, 14, 16, 7, 9, 13, 1…

$ Own <fct> No, Yes, No, Yes, No, No, Yes, No, Yes, Yes, No, No, Yes, …

$ Student <fct> No, Yes, No, No, No, No, No, No, No, Yes, No, No, No, No, …

$ Married <fct> Yes, Yes, No, No, Yes, No, No, No, No, Yes, Yes, No, Yes, …

$ Region <fct> South, West, West, West, South, South, East, West, South, …

$ Balance <dbl> 333, 903, 580, 964, 331, 1151, 203, 872, 279, 1350, 1407, …

$ Has_Balance <fct> Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, No,…Variables

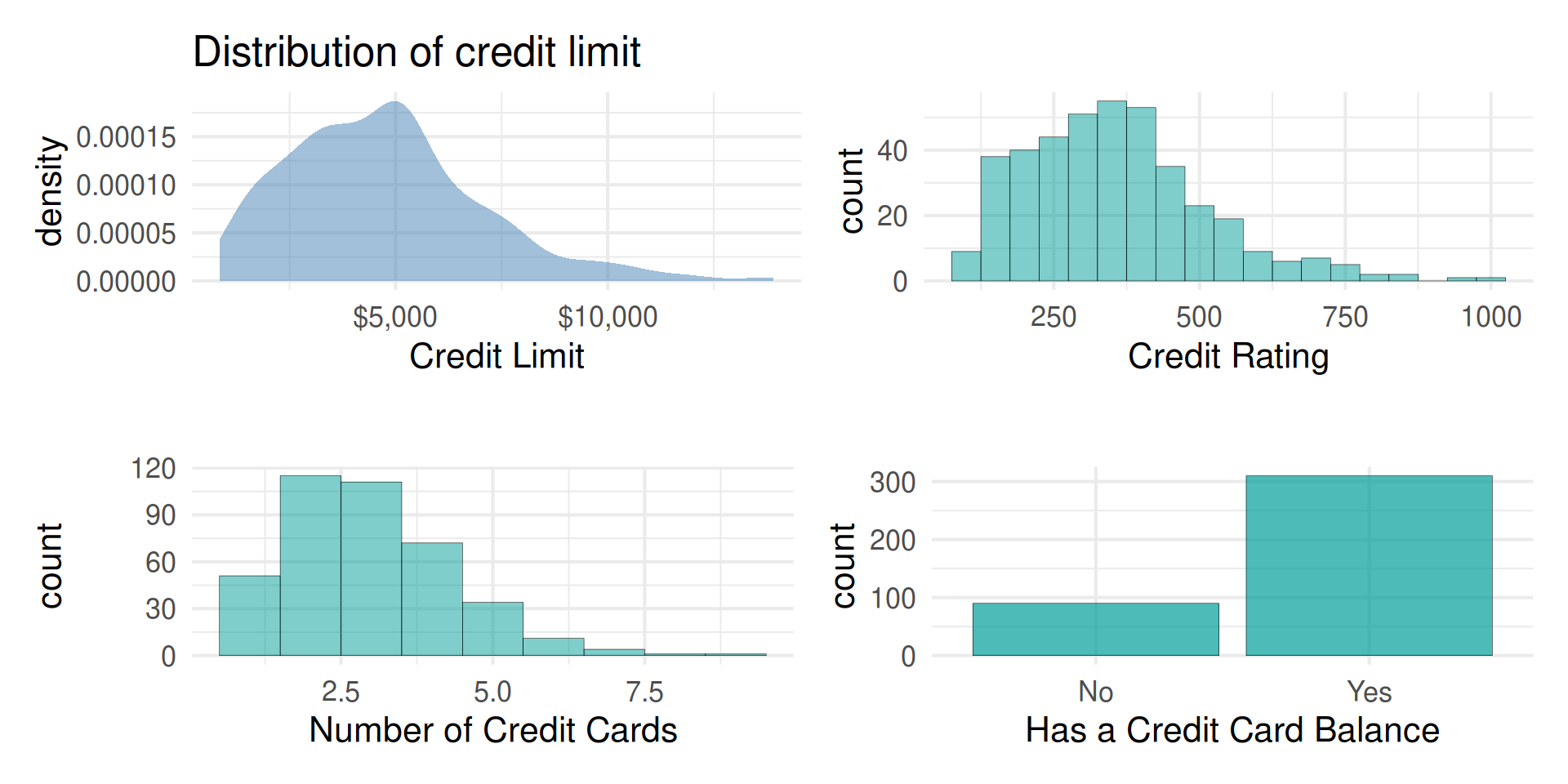

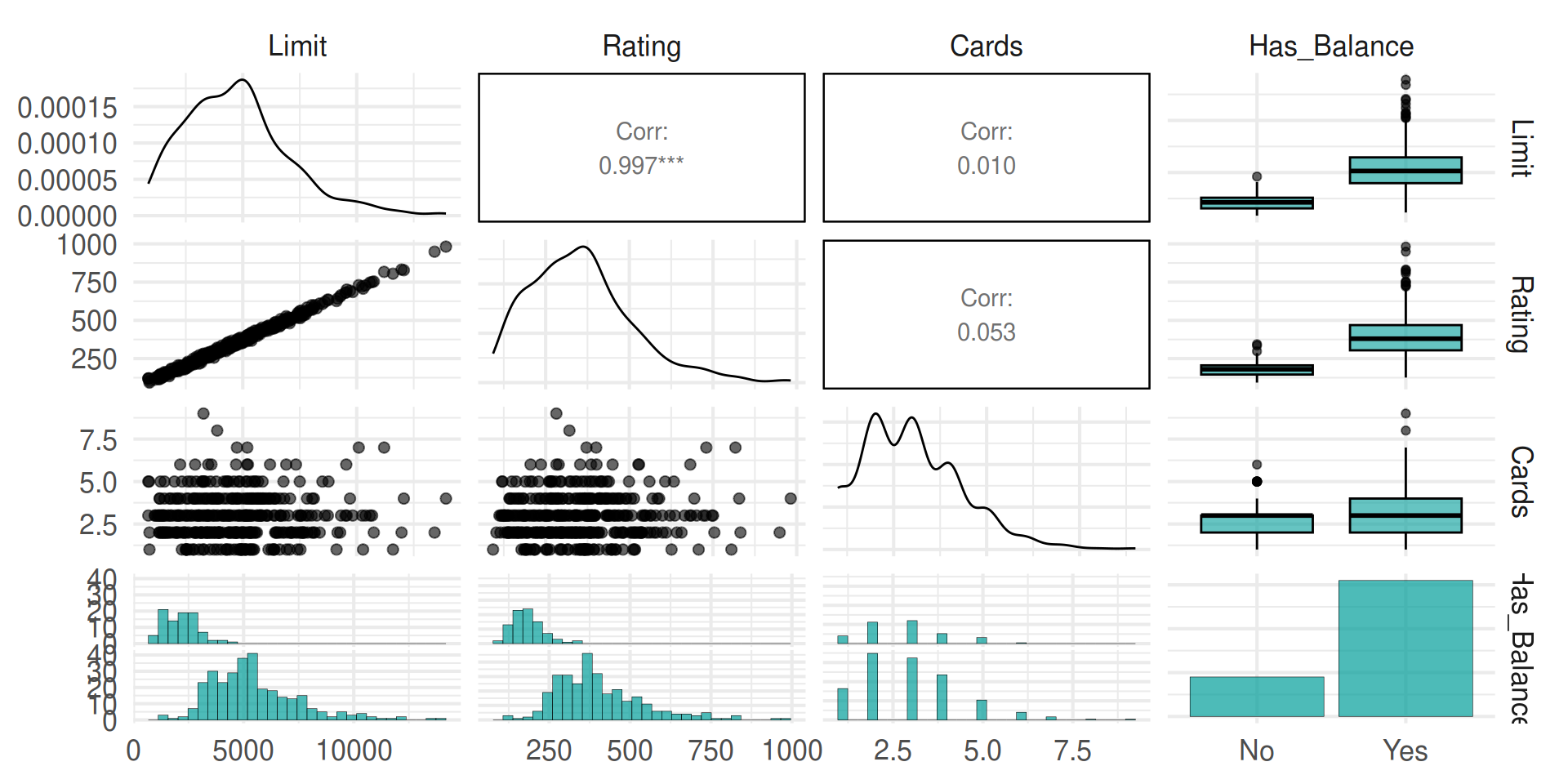

Features (another name for predictors)

Cards: Number of credit cardsRating: Credit RatingHas_Balance: Whether they have a credit card balance

Outcome

Limit: Credit limit

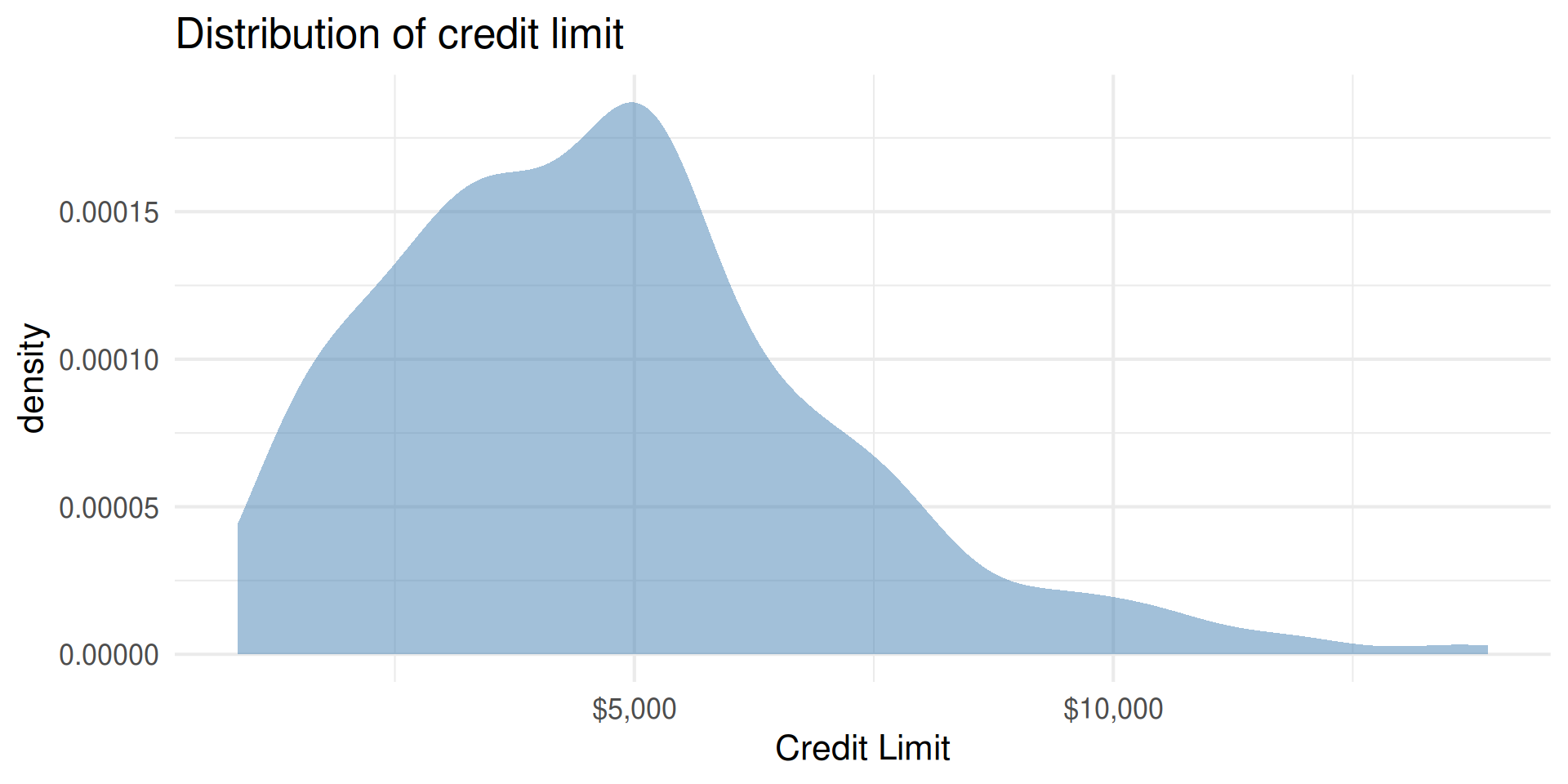

Outcome: Limit

| min | Q1 | median | Q3 | max | mean | sd | n | missing | |

|---|---|---|---|---|---|---|---|---|---|

| 855 | 3088 | 4622.5 | 5872.75 | 13913 | 4735.6 | 2308.199 | 400 | 0 |

Predictors

Code

p1 <- Credit |>

gf_density(~Limit, fill = "steelblue") |>

gf_labs(title = "Distribution of credit limit",

x = "Credit Limit")|>

gf_refine(scale_x_continuous(labels = dollar_format()))

p2 <- Credit |>

gf_histogram(~Rating, binwidth = 50) |>

gf_labs(title = "",

x = "Credit Rating")

p3 <- Credit |>

gf_histogram(~Cards, binwidth = 1) |>

gf_labs(title = "",

x = "Number of Credit Cards")

p4 <- Credit |>

gf_bar(~Has_Balance)|>

gf_labs(title = "",

x = "Has a Credit Card Balance")

(p1 + p2) / (p3 + p4)

Outcome vs. predictors

Single vs. multiple predictors

So far we’ve used a single predictor variable to understand variation in a quantitative response variable

Now we want to use multiple predictor variables to understand variation in a quantitative response variable

Multiple linear regression

Multiple linear regression (MLR)

Based on the analysis goals, we will use a multiple linear regression model of the following form

\[ \begin{aligned}\hat{\text{Limit}} ~ = \hat{\beta}_0 & + \hat{\beta}_1 \text{Rating} + \hat{\beta}_2 \text{Cards} \end{aligned} \]

Similar to simple linear regression, this model assumes that at each combination of the predictor variables, the values of Limit follow a Normal distribution.

Multiple linear regression

Recall: The simple linear regression model assumes

\[ Y|X\sim N(\beta_0 + \beta_1 X, \sigma_{\epsilon}^2) \]

Similarly: The multiple linear regression model assumes

\[ Y|X_1, X_2, \ldots, X_p \sim N(\beta_0 + \beta_1 X_1 + \beta_2 X_2 + \dots + \beta_p X_p, \sigma_{\epsilon}^2) \]

Multiple linear regression

At any combination of the predictors, the mean value of the response \(Y\), is

\[ \mu_{Y|X_1, \ldots, X_p} = \beta_0 + \beta_1 X_{1} + \beta_2 X_2 + \dots + \beta_p X_p \]

Using multiple linear regression, we can estimate the mean response for any combination of predictors

\[ \hat{Y} = \hat{\beta}_0 + \hat{\beta}_1 X_{1} + \hat{\beta}_2 X_2 + \dots + \hat{\beta}_p X_{p} \]

Model fit

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -341.15903 | 24.7670758 | -13.77470 | 0 |

| Rating | 14.90573 | 0.0496795 | 300.03798 | 0 |

| Cards | -72.31808 | 5.6054513 | -12.90138 | 0 |

Model equation

\[ \begin{align}\hat{\text{Limit}} = -341.159 &+14.906 \times \text{Rating}\\ & -72.318 \times \text{Cards} \end{align} \]

Interpreting \(\hat{\beta}_j\)

- The estimated coefficient \(\hat{\beta}_j\) is the expected change in the mean of \(y\) when \(x_j\) increases by one unit, holding the values of all other predictor variables constant.

Complete Exercises 4-6.

Prediction

What is the predicted credit limit for a borrower with these characteristics?

| Income | Limit | Rating | Cards | Age | Education | Own | Student | Married | Region | Balance | Has_Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 14.891 | 3606 | 283 | 2 | 34 | 11 | No | No | Yes | South | 333 | Yes |

The predicted credit limit for an borrower with an credit rating of 700 and who has 2 credit cards is $3733.

Prediction, revisited

Just like with simple linear regression, we can use the predict function in R to calculate the appropriate intervals for our predicted values:

fit lwr upr

1 3732.526 3430.472 4034.581Note

Difference in predicted value due to rounding the coefficients on the previous slide.

Complete Exercise 7.

Prediction interval for \(\hat{y}\)

Calculate a 90% confidence interval for the predicted credit limit for an individual borrower with a credit rating of 700, and who has 2 credit cards.

fit lwr upr

1 3732.526 3479.216 3985.837When would you use "confidence"? Would the interval be wider or narrower?

Cautions

- Do not extrapolate! Because there are multiple predictor variables, there is the potential to extrapolate in many directions

- The multiple regression model only shows association, not causality

- To show causality, you must have a carefully designed experiment or carefully account for confounding variables in an observational study

Wrap up

Recap

Introduced multiple linear regression

Interpreted coefficients in the multiple linear regression model

Calculated predictions and associated intervals for multiple linear regression models