# load packages

library(tidyverse) # for data wrangling and visualization

library(broom) # for formatting model output

library(ggformula) # for creating plots using formulas

library(scales) # for pretty axis labels

library(knitr) # for pretty tables

library(moderndive) # for house_price dataset

library(fivethirtyeight) # for fandango dataset

library(kableExtra) # also for pretty tables

library(patchwork) # arrange plots

# set default theme and larger font size for ggplot2

ggplot2::theme_set(ggplot2::theme_bw(base_size = 20))SLR: Transformations

Application exercise

📋 AE 10/11 - Transformations + Outliers: Complete in Deepnote

Complete Exercises 0-3.

Computational set up

Data: house_prices

- Contains house sale prices for King County, which includes Seattle, from homes sold between May 2014 and May 2015

- Obtained from Kaggle.com

- Imported from the

moderndivepackage

Rows: 21,613

Columns: 21

$ id <chr> "7129300520", "6414100192", "5631500400", "2487200875", …

$ date <date> 2014-10-13, 2014-12-09, 2015-02-25, 2014-12-09, 2015-02…

$ price <dbl> 221900, 538000, 180000, 604000, 510000, 1225000, 257500,…

$ bedrooms <int> 3, 3, 2, 4, 3, 4, 3, 3, 3, 3, 3, 2, 3, 3, 5, 4, 3, 4, 2,…

$ bathrooms <dbl> 1.00, 2.25, 1.00, 3.00, 2.00, 4.50, 2.25, 1.50, 1.00, 2.…

$ sqft_living <int> 1180, 2570, 770, 1960, 1680, 5420, 1715, 1060, 1780, 189…

$ sqft_lot <int> 5650, 7242, 10000, 5000, 8080, 101930, 6819, 9711, 7470,…

$ floors <dbl> 1.0, 2.0, 1.0, 1.0, 1.0, 1.0, 2.0, 1.0, 1.0, 2.0, 1.0, 1…

$ waterfront <lgl> FALSE, FALSE, FALSE, FALSE, FALSE, FALSE, FALSE, FALSE, …

$ view <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 3, 0, 0, 0,…

$ condition <fct> 3, 3, 3, 5, 3, 3, 3, 3, 3, 3, 3, 4, 4, 4, 3, 3, 3, 4, 4,…

$ grade <fct> 7, 7, 6, 7, 8, 11, 7, 7, 7, 7, 8, 7, 7, 7, 7, 9, 7, 7, 7…

$ sqft_above <int> 1180, 2170, 770, 1050, 1680, 3890, 1715, 1060, 1050, 189…

$ sqft_basement <int> 0, 400, 0, 910, 0, 1530, 0, 0, 730, 0, 1700, 300, 0, 0, …

$ yr_built <int> 1955, 1951, 1933, 1965, 1987, 2001, 1995, 1963, 1960, 20…

$ yr_renovated <int> 0, 1991, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0,…

$ zipcode <fct> 98178, 98125, 98028, 98136, 98074, 98053, 98003, 98198, …

$ lat <dbl> 47.5112, 47.7210, 47.7379, 47.5208, 47.6168, 47.6561, 47…

$ long <dbl> -122.257, -122.319, -122.233, -122.393, -122.045, -122.0…

$ sqft_living15 <int> 1340, 1690, 2720, 1360, 1800, 4760, 2238, 1650, 1780, 23…

$ sqft_lot15 <int> 5650, 7639, 8062, 5000, 7503, 101930, 6819, 9711, 8113, …Variables

- Outcome

price: the sale price in dollars

- Predictor

sqft_living: the square footage of the home

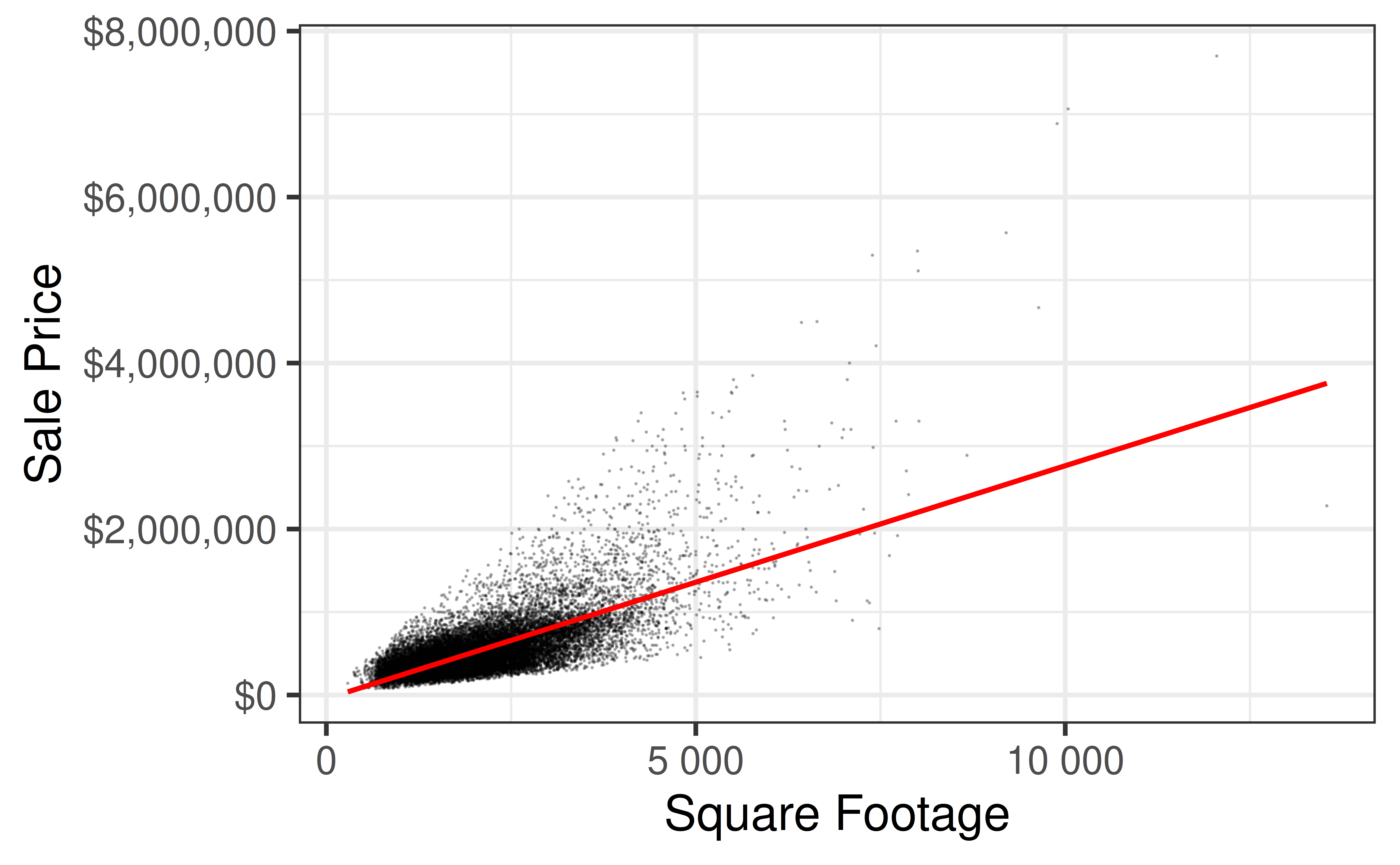

Recap: Fit the model

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -43580.7431 | 4402.689690 | -9.898663 | 0 |

| sqft_living | 280.6236 | 1.936399 | 144.920356 | 0 |

- Write down the model:

- Model: \(\hat{\text{price}} = -43580.74 + 280.62\times\text{sqft_living}\)

- Interpret the slope and intercept in the context of this problem:

- Interpretation: If the square footage of the house increases by 1, the price increases by and average of $280.62 and a (theoretical) house with 0 square feet with cost -$43,580.74.

Recap: Fit the model

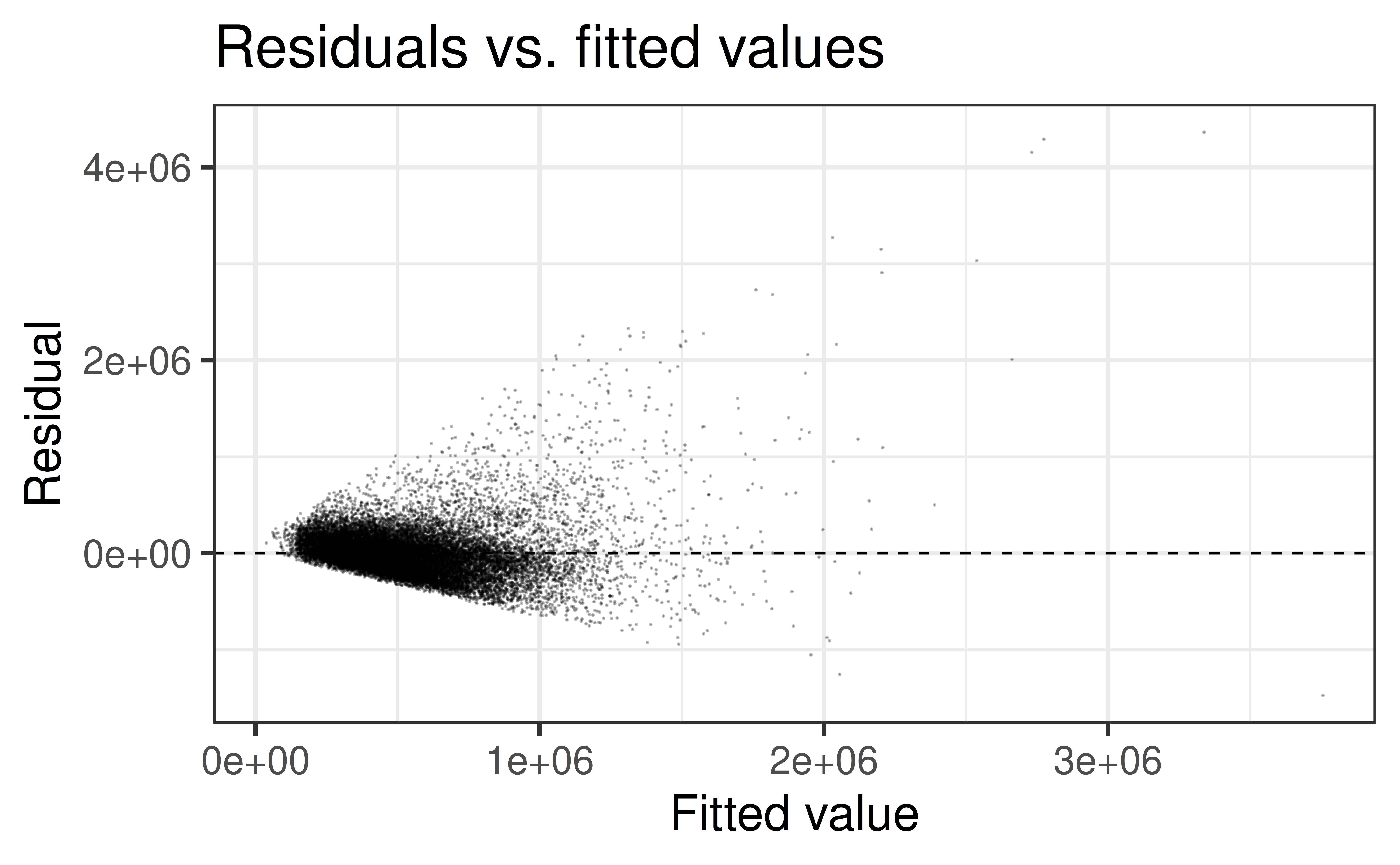

Recap: Model conditions

- Linearity: There is a linear relationship between the outcome and predictor variables

- Constant variance: The variability of the errors is equal for all values of the predictor variable

- Normality: The errors follow a normal distribution

- Independence: The errors are independent from each other

How should we check these assumptions?

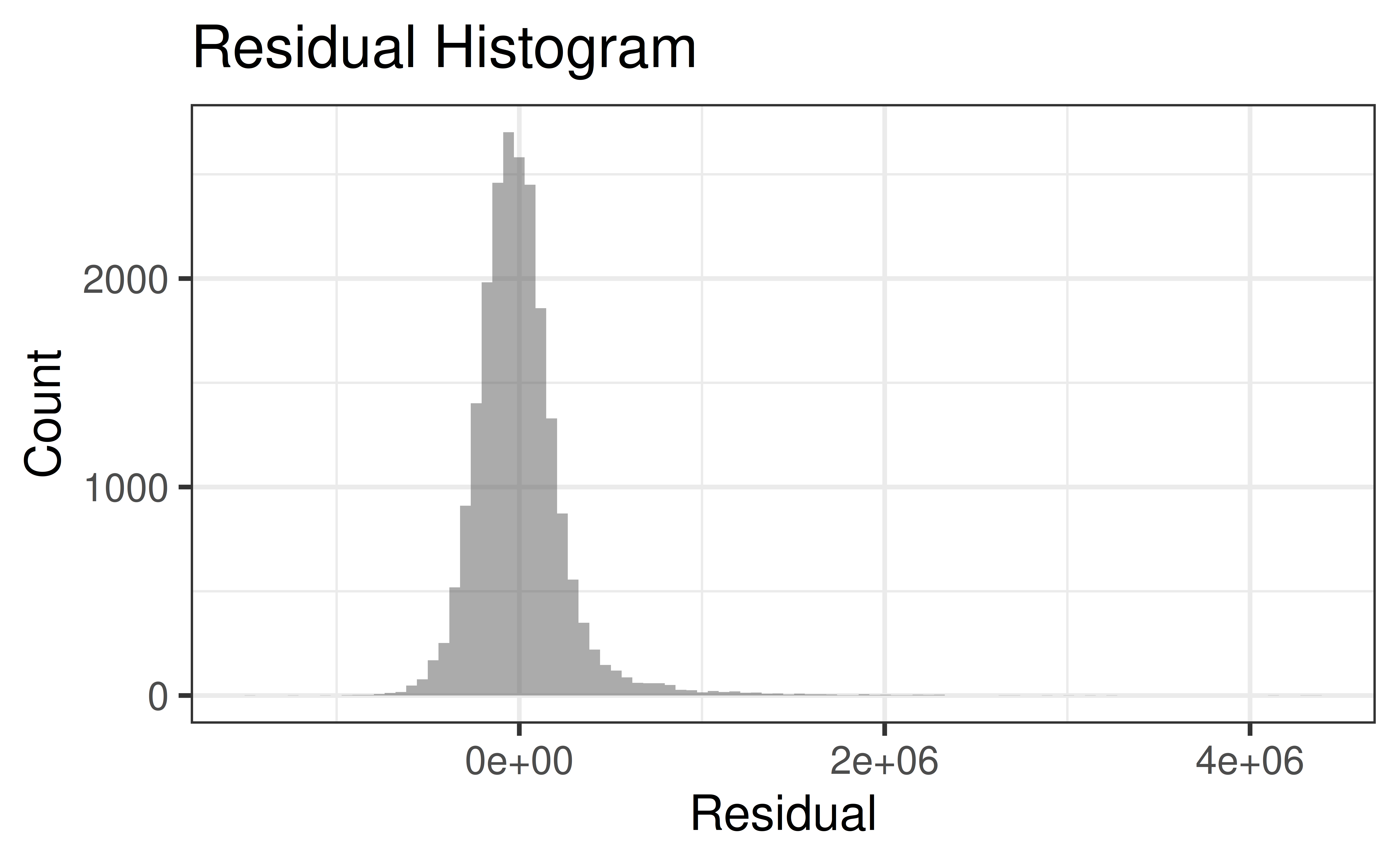

Recap: Residual Histogram

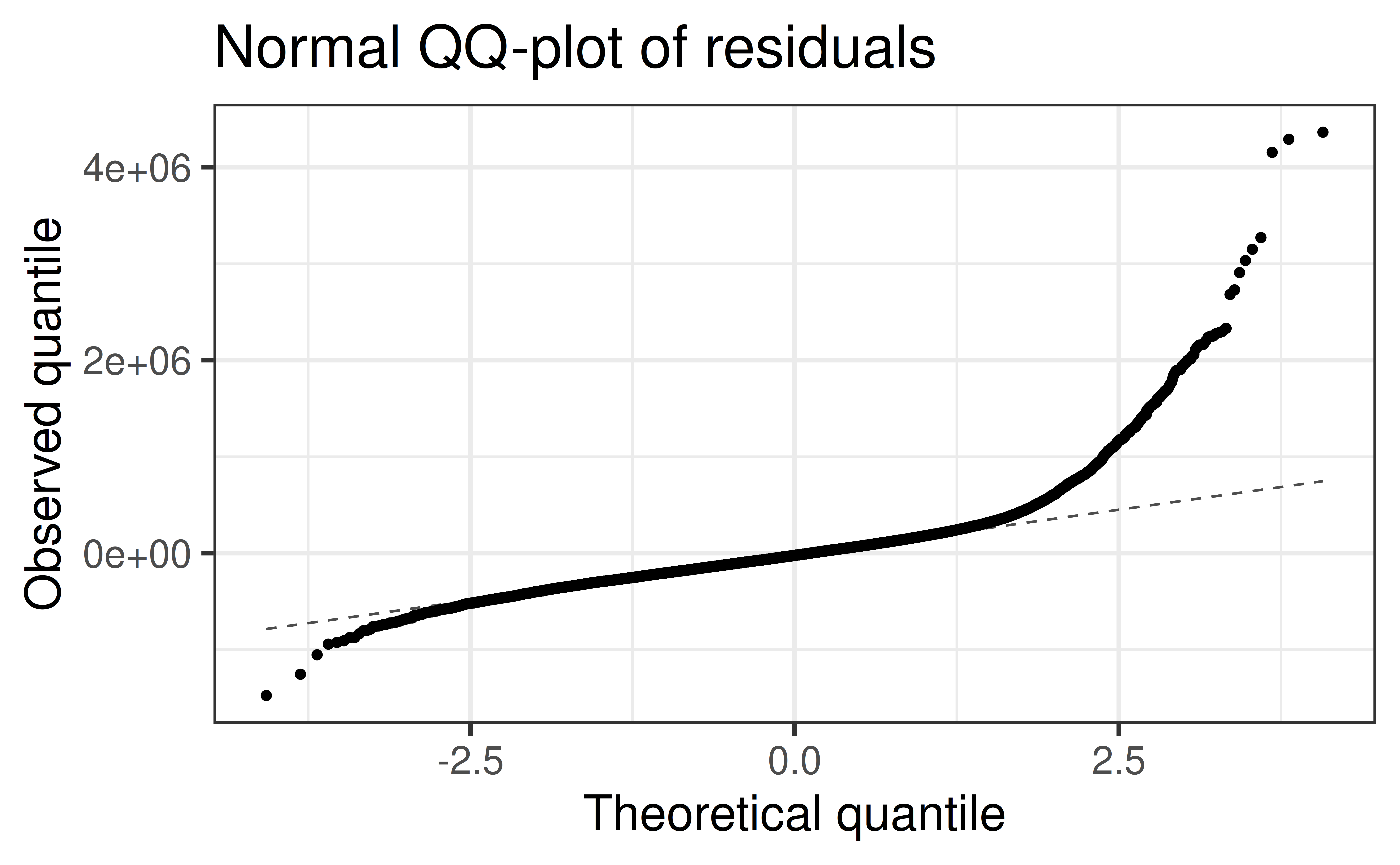

Recap: QQ-Plot of Residuals

Recap: Residuals vs. Fitted Values

Are model conditions satisfied?

- Linearity:

❓ - Constant variance:

❌ - Normality:

❌ - Independence:

❓

What to do when regression conditions are violated

Examples:

- Lack of normality in residuals

- Patterns in residuals

- Heteroscedasticity (non-constant variance)

- Outliers: influential points, large residuals

Transformations

Data Transformations

Can be used to:

- Address nonlinear patterns

- Stabilize variance

- Remove skewness from residuals

- Minimize effects of outliers

Common Transformations

For either the response \(Y\) or predictor \(X\):

- Logarithm \(Z \to \log(Z)\)

- Note: “log” means “log base \(e\)”

- Square Root \(Z \to \sqrt{Z}\)

- Exponential \(Z \to e^Z\)

- Power functions \(Z \to Z^2, Z^3, Z^4, \ldots\)

- Reciprocal \(Z \to 1/Z\)

General Approach

- Fix non-constant variance by transforming \(Y\) (do this first)

- Fan Pattern: Log-Transform \(Y\)

- Fix non-linearity by transforming \(X\)

Why a Log Transformation?

Some relationship are multiplicative (not linear)

Example: Area of a circle

\[ \begin{aligned} A &= \pi r^2 \text{ (not linear)}\\ \log(A) &= \log(\pi r^2) = \log(\pi) + 2\log(r)\\ \log(A) &= \beta_0 + \beta_1\times \log(r)\\ \implies & \log(A) \text{ is a linear function of } \log(r) \end{aligned} \]

Look for:

- Increasing variability in scatterplot

- Strongly right-skewed residual distributions

- Complete Exercise 4

Fixing non-linearity

Many departures from linearity can be solved with power transformations (e.g. \(X^{power}\))

- For technical reasons, \(power = 0\) corresponds to \(\log\)

Concave down pattern \(\Rightarrow\) transform down (i.e. \(power < 1\))

- \(\log\) is typically a good first choice

Concave up pattern \(\Rightarrow\) transform up (i.e. \(power > 1\))

Complete Exercises 5-7.

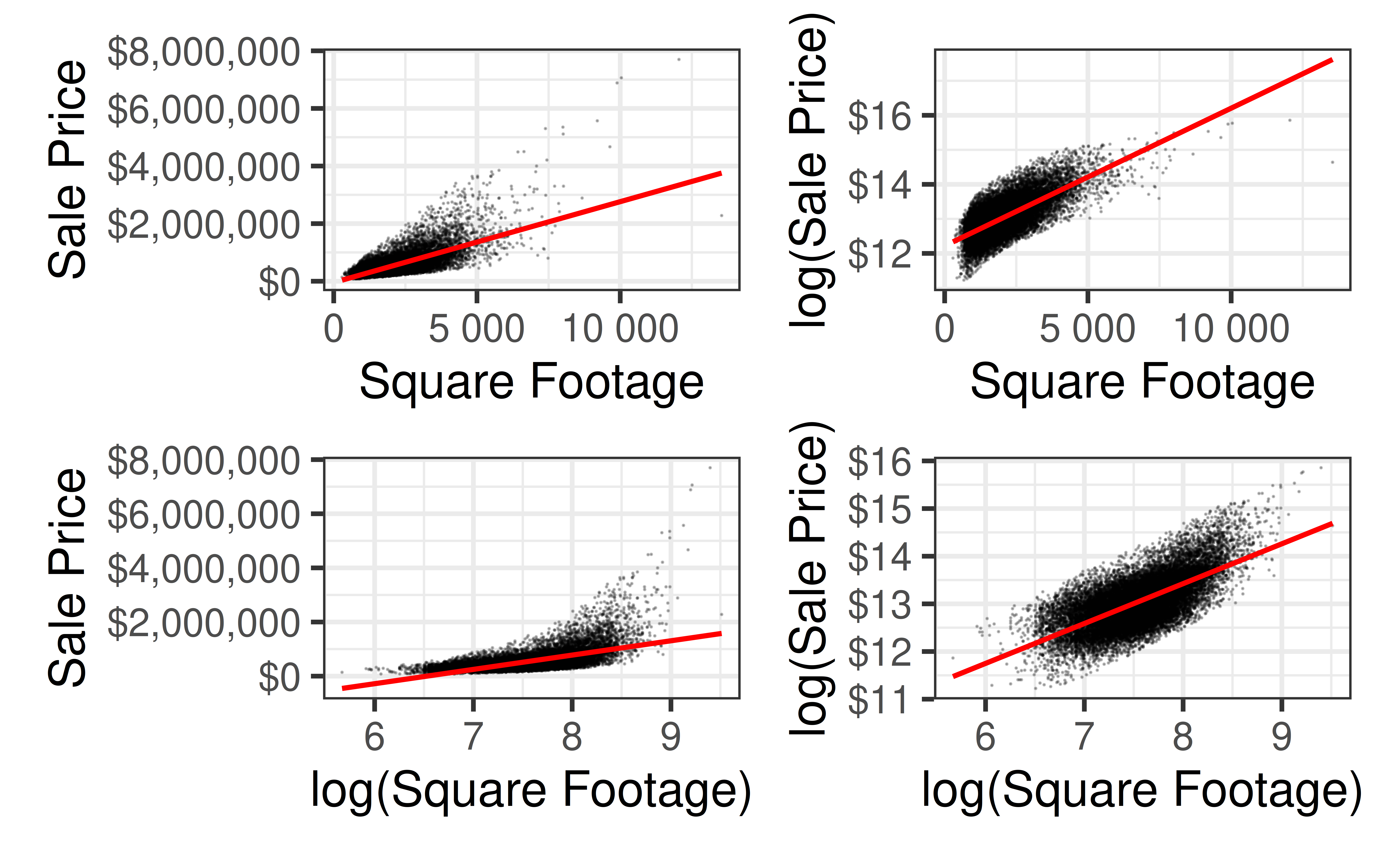

Back to house_sales

Code

p1 <- gf_point(price ~ sqft_living, data = house_prices,

alpha = 0.25, size = 0.01) |>

gf_smooth(method = "lm", color = "red") |>

gf_labs(x = "Square Footage",

y = "Sale Price") |>

gf_refine(scale_y_continuous(labels = label_dollar()),

scale_x_continuous(labels = label_number()))

p2 <- gf_point(log(price) ~ sqft_living, data = house_prices,

alpha = 0.25, size = 0.01) |>

gf_smooth(method = "lm", color = "red") |>

gf_labs(x = "Square Footage",

y = "log(Sale Price)") |>

gf_refine(scale_y_continuous(labels = label_dollar()),

scale_x_continuous(labels = label_number()))

p3 <- gf_point(price ~ log(sqft_living), data = house_prices,

alpha = 0.25, size = 0.01) |>

gf_smooth(method = "lm", color = "red") |>

gf_labs(x = "log(Square Footage)",

y = "Sale Price") |>

gf_refine(scale_y_continuous(labels = label_dollar()),

scale_x_continuous(labels = label_number()))

p4 <- gf_point(log(price) ~ log(sqft_living), data = house_prices,

alpha = 0.25, size = 0.01) |>

gf_smooth(method = "lm", color = "red") |>

gf_labs(x = "log(Square Footage)",

y = "log(Sale Price)") |>

gf_refine(scale_y_continuous(labels = label_dollar()),

scale_x_continuous(labels = label_number()))

(p1 + p2)/ (p3 + p4)

Fitting Transformed Models

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 12.2184641 | 0.0063741 | 1916.8830 | 0 |

| sqft_living | 0.0003987 | 0.0000028 | 142.2326 | 0 |

\[ \begin{aligned} \log(Y) &= 12.22 + 3.99\times 10^{-4}\times X\\ Y &= e^{12.22 + 3.99\times 10^{-4}\times X}\\ &= 202805\times e^{3.99\times 10^{-4}\times X} \end{aligned} \]

loglog_model <- lm(log(price) ~ log(sqft_living), data = house_prices)

tidy(loglog_model) |> kable()| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 6.729916 | 0.0470620 | 143.0011 | 0 |

| log(sqft_living) | 0.836771 | 0.0062233 | 134.4587 | 0 |

\[ \begin{aligned} \log(Y) &=6.73 + 0.837\times \log(X)\\ \log(Y) &= \log(e^{6.73}) + \log(X^{0.837})\\ Y &= 873.15\times X^{0.837} \end{aligned} \]

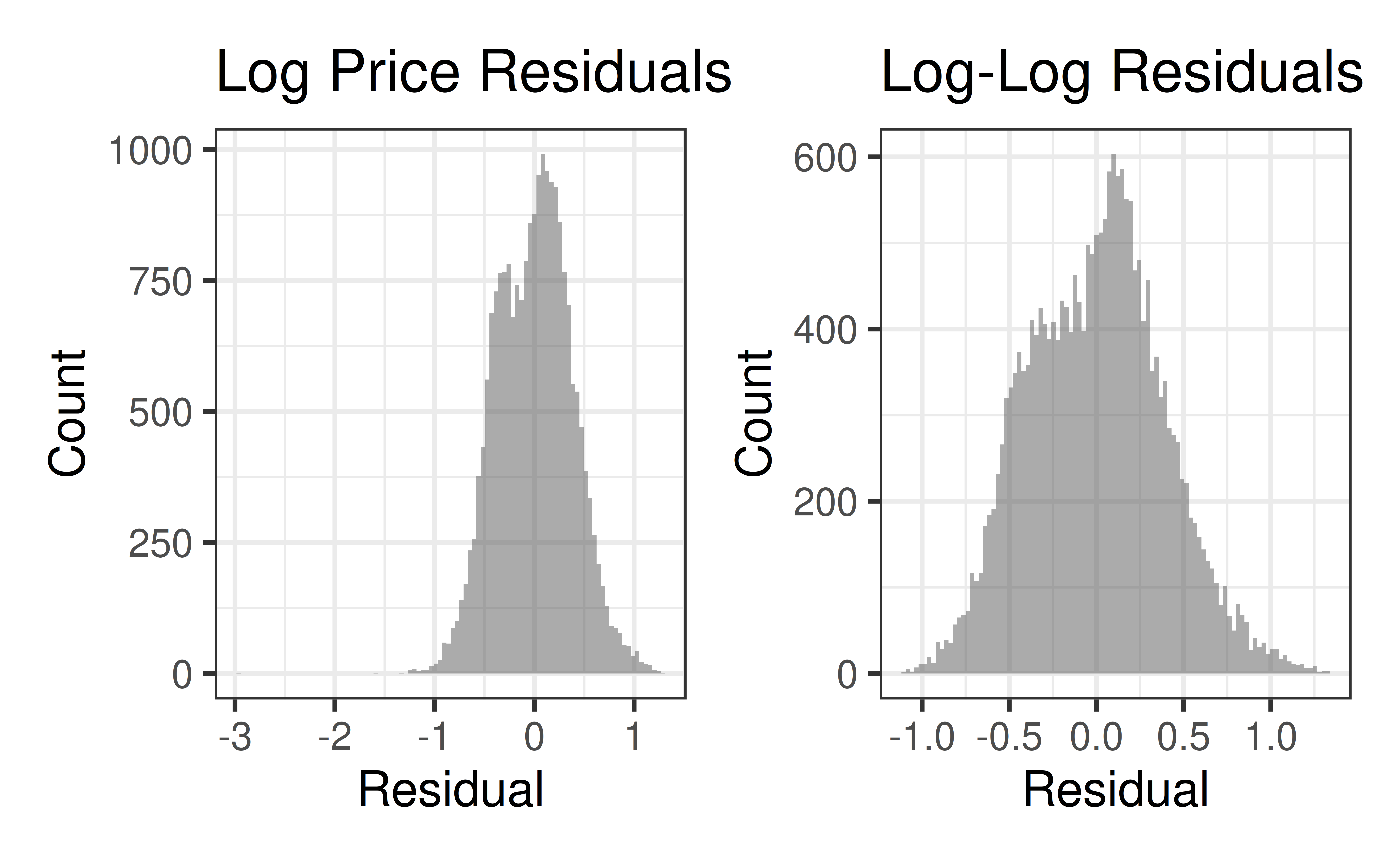

Residuals Histograms

Code

lp_aug <- augment(logprice_model)

ll_aug <- augment(loglog_model)

p1 <- gf_histogram(~.resid, data = lp_aug, bins = 100) |>

gf_labs(x = "Residual",

y = "Count",

title = "Log Price Residuals")

p2 <- gf_histogram(~.resid, data = ll_aug, bins = 100) |>

gf_labs(x = "Residual",

y = "Count",

title = "Log-Log Residuals")

(p1 + p2)

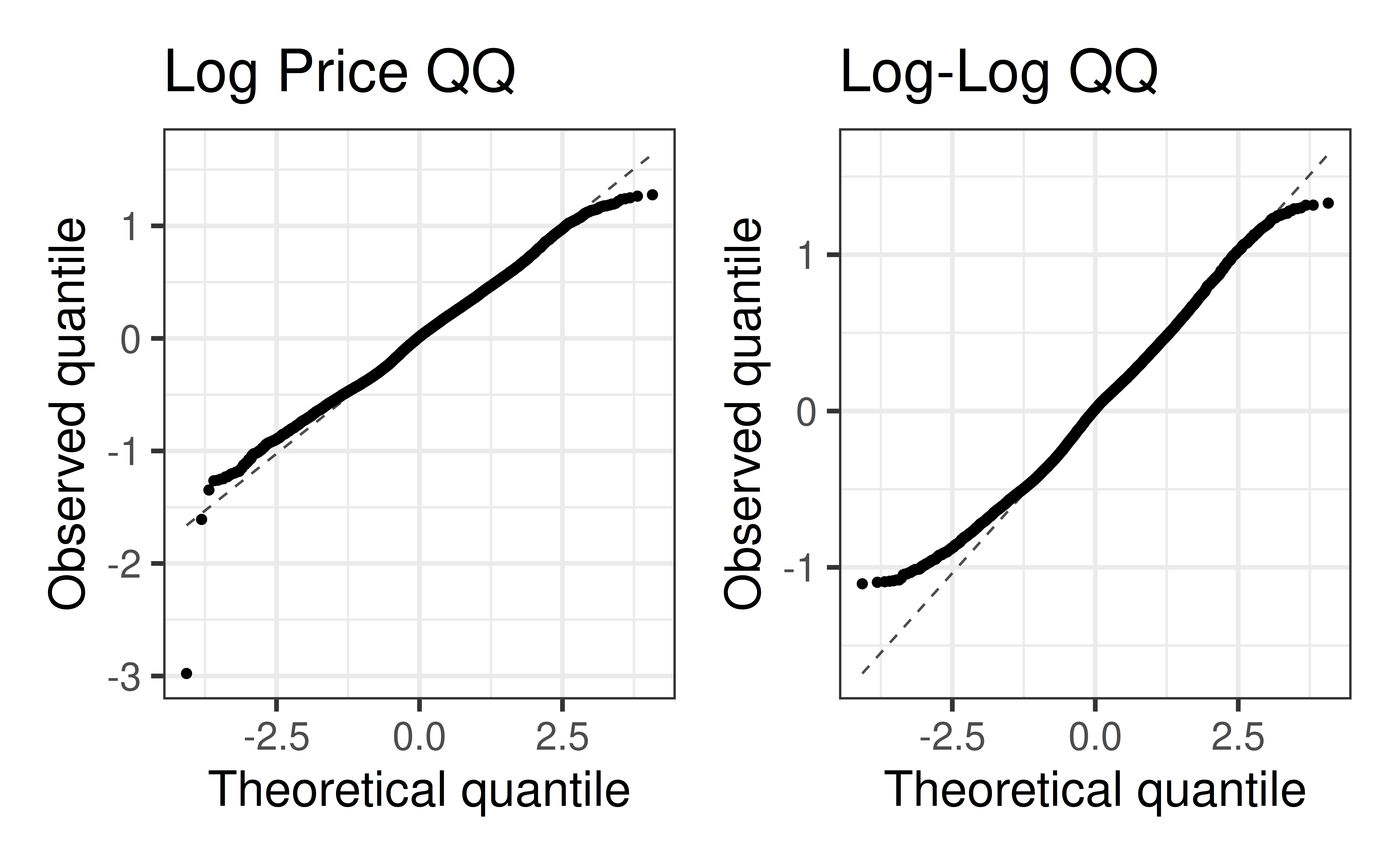

QQ-Plots of Residuals

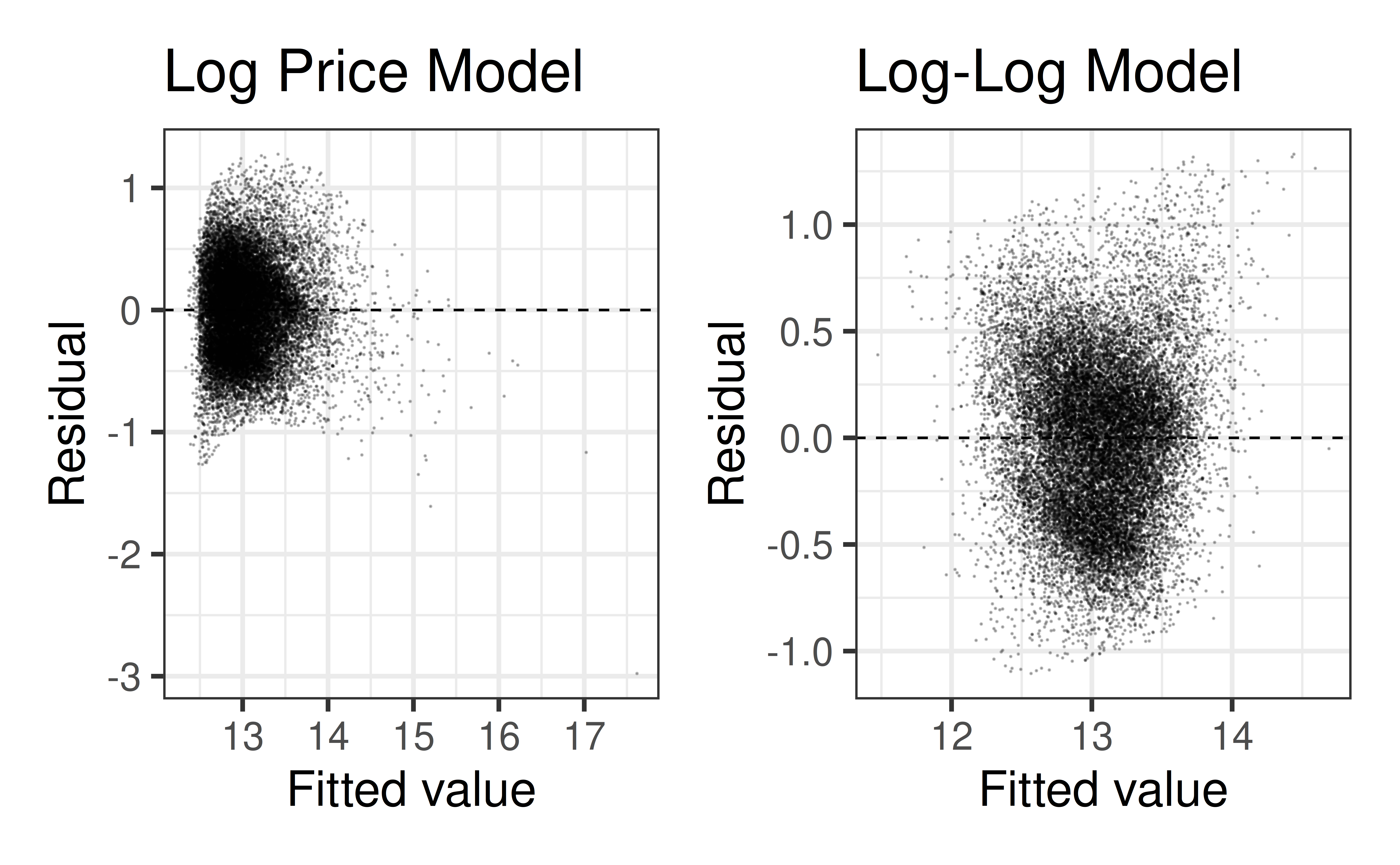

Residuals vs. Fitted Values

Code

p1 <- gf_point(.resid ~ .fitted, data = lp_aug,

alpha = 0.25, size = 0.01) |>

gf_hline(yintercept = 0, linetype = "dashed") |>

gf_labs(

x = "Fitted value", y = "Residual",

title = "Log Price Model"

)

p2 <- gf_point(.resid ~ .fitted, data = ll_aug,

alpha = 0.25, size = 0.01) |>

gf_hline(yintercept = 0, linetype = "dashed") |>

gf_labs(

x = "Fitted value", y = "Residual",

title = "Log-Log Model"

)

p1 + p2

A note on evaluation

If you are computing your evaluation metrics (e.g. \(R^2\) or RMSE), you should transform your predictions BACK to their original scale, especially if you’re trying to choose the best model

- Why do we need to undo the transformation for evaluation metrics by not residuals plots?

- Why don’t we need to worry about the predictors?

Recap

- Transformations

- Transform \(Y\) to fix non-constant variance (and non-normality)

- Transform \(X\) to fix non-linearity

- Power transformations are powerful (concave up/drown \(\Rightarrow\) power up/down)

- logs allow us to model a lot of non-linear relationships with a linear model